National Pension Scheme (NPS) for NRIs: Your Path to a Secure Retirement

Sushrut Phadke

Founder's Office

Feb 5, 2025

Introduction

Do you want to plan a retired life in India with your loved ones and family? You need to plan a safe strategy for your finances.

NPS is a well-structured retirement savings plan available to Indian citizens, including Non-Resident Indians. But its suitability to NRIs is subjective and depends on the financial goals, tax considerations, and retirement plans of the individual. This blog will provide updated information as of January 2025 to help NRIs make the right decision.

Let's start with the basics.

What is NPS?

The National Pension Scheme, or NPS, is a government-backed retirement savings plan regulated by the Pension Fund Regulatory and Development Authority, or PFRDA. It is open to Indian citizens, including NRIs between 18-60 years complying with KYC norms. Please Note: PIOs are not eligible

Ideally, NPS is suitable for NRIs, who want to create a corpus in INR and have pension income periodically during retirement. Before we go any further, let's understand a few things first.

Key Features:

Account Types:

Tier I: Mandatory retirement account with tax benefits and withdrawal restrictions.

Tier II: Voluntary savings account with liquidity but no tax benefits.

Tax Benefits:

You can claim deductions of up to ₹2 lakh under Sections 80CCD(1) and 80CCD(1B). Upon reaching the age of 60, NPS subscribers are allowed to withdraw up to 60% of their accumulated corpus tax-free, while the remaining 40% must be used to purchase an annuity. The income from this annuity is taxed according to your applicable slab. For US-based NRIs, there’s a bit of relief—unlike certain other Indian investments, the NPS isn’t classified as a Passive Foreign Investment Company (PFIC), which helps simplify reporting requirements and reduces potential tax complications in the US.

Other Benefits:

Investment Options: Funds are invested in a mix of equities, bonds, and government securities. Subscribers can choose their allocation or opt for auto allocation.

Returns: Market-linked returns (historically 8–10% annually).

Withdrawals:

At 60: 60% of the corpus is tax-free, while 40% is used for a mandatory annuity.

Premature Exit: Partial withdrawal allowed after 5 years.

Example:

Assuming a monthly contribution of $500 (approximately ₹43,000) to the National Pension System (NPS) over 30 years, with an annual growth rate of 10%, here's an overview of the projected retirement corpus and tax implications:

Withdrawal at Age 60:

Lump Sum Withdrawal (60%): Approximately ₹60L.

Tax Implication: This amount is exempt from tax.

Annuity Purchase (40%): Approximately ₹40L.

Annuity Income: The monthly pension depends on the annuity rate offered by the chosen service provider. For instance, with an annuity rate of 6% per annum, the annual pension would be approximately ₹2.4L.

This translates to a monthly pension of approximately ₹20,000..

Tax Implication: The annuity income is taxable as per the individual's applicable tax slab.

Summary:

Total Corpus at Retirement (Age 60): ~ ₹1 Cr

Lump Sum Withdrawal (60%): ~₹60L (Tax-Free)

Annuity Purchase (40%): ~₹40L

Annual Pension: ₹2.4L (Taxable)

Monthly Pension: ~₹20,000

Note: The actual annuity rates and tax laws may vary at the time of retirement. It's advisable to consult with a financial advisor for personalized planning.

NPS is a tax-efficient, flexible, and disciplined way to build a retirement corpus. It’s especially beneficial for individuals planning to retire in India.

Eligibility for NRIs

Any Non-Resident Indian aged 18 to 70 years can subscribe to NPS, provided they:

Hold a valid PAN card.

Have a NRI bank account (NRE/NRO accounts are acceptable).

Comply with the Know Your Customer (KYC) norms set by the respective Point of Presence (PoP).

Please Note: Overseas Citizens of India (OCIs) and Persons of Indian Origin (PIOs) are not eligible to open an NPS account.

Why Should NRIs Consider the NPS?

NPS offers several advantages for NRIs, particularly those planning their retirement in India:

Tax Benefits:

Contributions up to ₹1.5 lakh under Section 80CCD(1) and an additional ₹50,000 under Section 80CCD(1B) are tax-deductible under the old tax regime. This makes it a tax-efficient way to build a retirement corpus if NRIs file taxes in India.

Disciplined Retirement Savings:

NPS promotes regular savings with a structured approach to retirement planning. Contributions are invested in a mix of equity, debt, and government securities, offering a balance of growth and stability.

Potentially High Returns:

Over the years, NPS has provided average annualized returns of 8–10%, particularly for equity-heavy allocations. Subscribers can allocate up to 75% of their funds to equity for long-term growth.

Flexibility and Customization:

NRIs can select investment choices and adjust asset allocation based on their risk appetite.

Who Should Invest in NPS?

1. NRIs Planning Retirement in India:

NPS is most beneficial for NRIs who plan to settle in India post-retirement.

Tax benefits and pension income in INR align well with their financial needs in India.

2. Risk-Averse NRIs:

NPS provides a balanced mix of equities and debt, making it suitable for those seeking steady, low-risk returns.

How to Enroll in NPS as an NRI

Choose a Point of Presence (PoP):

A Point of Presence (PoP) is an entity authorized by the PFRDA to help individuals register for the National Pension System (NPS). PoPs, typically banks and financial institutions, assist with account opening, KYC verification, contributions, and updates.

Major banks like SBI, ICICI Bank, HDFC Bank, and Axis Bank serve as PoPs, along with some non-banking financial institutions and post offices. When choosing a PoP, consider factors like service quality, branch accessibility, digital support, and any service charges.

Complete the Application:

Fill out the NPS registration form, available online or at PoP branches. NRIs can also register via the eNPS platform for a seamless digital experience.Submit Documents:

Ensure the following documents are in order:PAN card.

Proof of Indian address or overseas address (as per PoP requirements).

Bank account details (NRE/NRO).

Make the First Contribution:

Deposit the initial amount to activate your NPS account.Receive the PRAN:

Upon successful registration, you will be allotted a Permanent Retirement Account Number (PRAN), which serves as your unique identifier for all NPS-related transactions.

Now let’s understand how you can make a recurring investment to your NPS?

You can make periodic investments in the National Pension Scheme (NPS) as an NRI through a Standing Instruction (SI) from your NRE or NRO bank account, which, in effect, gives you a SIP-like feature where a predetermined amount is debited from your account and automatically invested in your NPS every month or at any other frequency you choose; you can do this online by logging into the eNPS portal or even by submitting a physical form to your bank branch.

You can set a standing instruction through the eNPS portal here.

But before you begin your NPS journey, you need an NRE/NRO account

In case you already have a NRE/NRO account, you can skip to the next step.

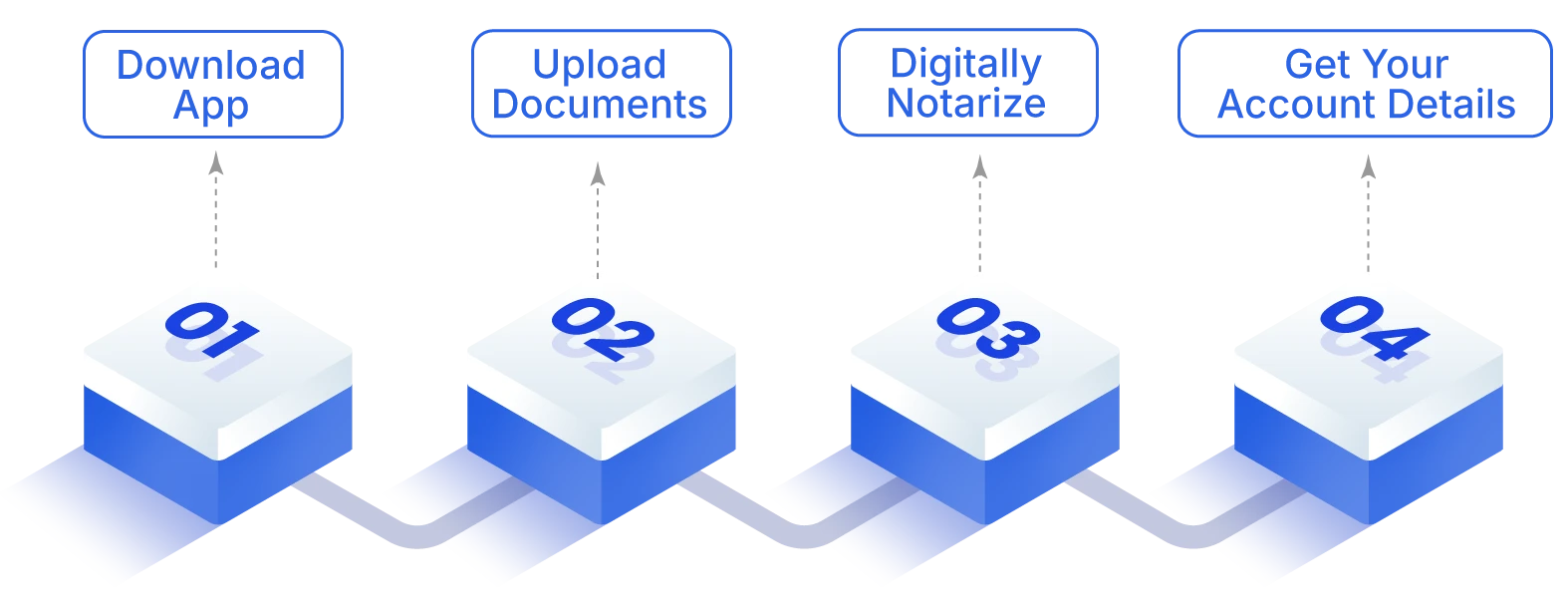

In case you don’t have one already, you can get an account within the next 24 hours with Rupeeflo. Here’s how:

After you have completed the above 4-step process, you have to make the First Transfer for Activation within (T+1) day or within 24 hours.

As a followup step, we will deliver your “Welcome Kit and Complete Full Activation”. The welcome kit is delivered within 2-3 days and the account is fully activated upon confirmation of address.

Click here to download the app now.

Does NPS Make Sense for NRIs Retiring Outside India?

For NRIs planning to retire abroad, NPS may not be the best option. Consider these factors:

Currency Risk: The annuity income is disbursed in INR, which could depreciate over time.

Double Taxation: Without favorable Double Taxation Avoidance Agreements (DTAAs), NRIs may face tax liabilities both in India and their country of residence.

Alternative Options Abroad: NRIs retiring outside India may find globally accessible retirement plans or investments in their country of residence more practical.

Conclusion

The NPS can be a valuable tool for NRIs planning retirement in India due to its tax benefits, disciplined savings, and guaranteed pension income. However, it may not be ideal for NRIs retiring abroad due to currency risks and taxation challenges.

Before making a decision, NRIs should carefully assess their retirement goals, financial needs, and tax obligations in both India and their country of residence. Consulting a financial advisor with expertise in cross-border investments can help make an informed choice.